Discover us

Our methodology

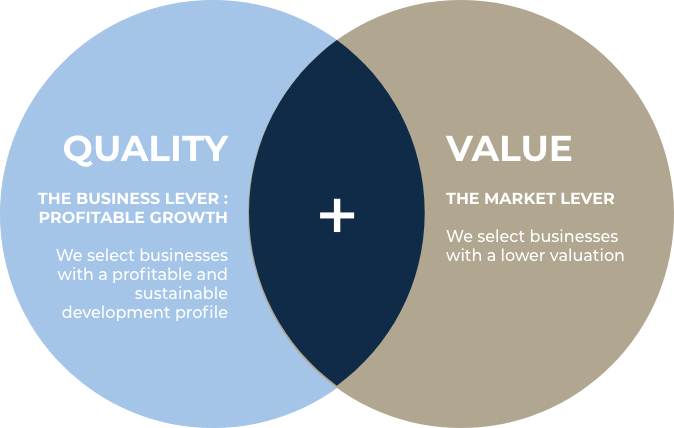

Our methodology Quality Value, was designed by William Higgons from 1992 onwards.

Today, our goal remains the same:

Building a portfolio of profitable investment with limited risks. We seek profitable, growing businesses (Quality), with a low market capitalization (Value).

To achieve it, we stick to this methodology to elaborate:

- tangible, measurable criteria to select our investment,

- an active management process to maintain an undervalued portfolio.

Indépendance AM’s investment universe: profitable growth AND low valuation

Building our portfolio

Our judgment relies on:

financial analysis of the business

meetings with the leaders

qualitative analysis of the market

ESG analysis of the business

We set up over 500 meetings per year with business leaders from our investment universe.

Our management

Our management focuses on a long-term relationship with the companies we invest in.

“Investing

is not speculating”

Benjamin Graham

Security Analysis, 1934

50%

of the businesses received investment from our funds for more than 10 years

16

years

our oldest

investment (since 2006)

4-5

years

is the median duration of our investments